36. Univariate Time Series with Matrix Algebra#

36.1. Overview#

This lecture uses matrices to solve some linear difference equations.

As a running example, we’ll study a second-order linear difference equation that was the key technical tool in Paul Samuelson’s 1939 article [Samuelson, 1939] that introduced the multiplier-accelerator model.

This model became the workhorse that powered early econometric versions of Keynesian macroeconomic models in the United States.

You can read about the details of that model in Samuelson Multiplier-Accelerator.

(That lecture also describes some technicalities about second-order linear difference equations.)

In this lecture, we’ll also learn about an autoregressive representation and a moving average representation of a non-stationary

univariate time series

We’ll also study a “perfect foresight” model of stock prices that involves solving a “forward-looking” linear difference equation.

We will use the following imports:

import numpy as np

import matplotlib.pyplot as plt

from matplotlib import cm

# Custom figsize for this lecture

plt.rcParams["figure.figsize"] = (11, 5)

# Set decimal printing to 3 decimal places

np.set_printoptions(precision=3, suppress=True)

36.2. Samuelson’s model#

Let

For

where we assume that

In Samuelson’s model,

Equation (36.1) is called a second-order linear difference equation. It is called second order because it depends on two lags.

But actually, it is a collection of

Note

To be able to solve a second-order linear difference equation, we require two boundary conditions that can take the form either of two initial conditions, two terminal conditions or possibly one of each.

Let’s write our equations as a stacked system

or

where

Evidently

The vector

Let’s put Python to work on an example that captures the flavor of Samuelson’s multiplier-accelerator model.

We’ll set parameters equal to the same values we used in Samuelson Multiplier-Accelerator.

T = 80

# parameters

α_0 = 10.0

α_1 = 1.53

α_2 = -.9

y_neg1 = 28.0 # y_{-1}

y_0 = 24.0

Now we construct

A = np.identity(T) # The T x T identity matrix

for i in range(T):

if i-1 >= 0:

A[i, i-1] = -α_1

if i-2 >= 0:

A[i, i-2] = -α_2

b = np.full(T, α_0)

b[0] = α_0 + α_1 * y_0 + α_2 * y_neg1

b[1] = α_0 + α_2 * y_0

Let’s look at the matrix

A, b

(array([[ 1. , 0. , 0. , ..., 0. , 0. , 0. ],

[-1.53, 1. , 0. , ..., 0. , 0. , 0. ],

[ 0.9 , -1.53, 1. , ..., 0. , 0. , 0. ],

...,

[ 0. , 0. , 0. , ..., 1. , 0. , 0. ],

[ 0. , 0. , 0. , ..., -1.53, 1. , 0. ],

[ 0. , 0. , 0. , ..., 0.9 , -1.53, 1. ]]),

array([ 21.52, -11.6 , 10. , 10. , 10. , 10. , 10. , 10. ,

10. , 10. , 10. , 10. , 10. , 10. , 10. , 10. ,

10. , 10. , 10. , 10. , 10. , 10. , 10. , 10. ,

10. , 10. , 10. , 10. , 10. , 10. , 10. , 10. ,

10. , 10. , 10. , 10. , 10. , 10. , 10. , 10. ,

10. , 10. , 10. , 10. , 10. , 10. , 10. , 10. ,

10. , 10. , 10. , 10. , 10. , 10. , 10. , 10. ,

10. , 10. , 10. , 10. , 10. , 10. , 10. , 10. ,

10. , 10. , 10. , 10. , 10. , 10. , 10. , 10. ,

10. , 10. , 10. , 10. , 10. , 10. , 10. , 10. ]))

Now let’s solve for the path of

If

To solve

A_inv = np.linalg.inv(A)

y = A_inv @ b

or we can use np.linalg.solve:

y_second_method = np.linalg.solve(A, b)

Here make sure the two methods give the same result, at least up to floating point precision:

np.allclose(y, y_second_method)

True

# Check if A is lower triangular

np.allclose(A, np.tril(A))

True

Note

In general, np.linalg.solve is more numerically stable than using

np.linalg.inv directly.

However, stability is not an issue for this small example. Moreover, we will

repeatedly use A_inv in what follows, so there is added value in computing

it directly.

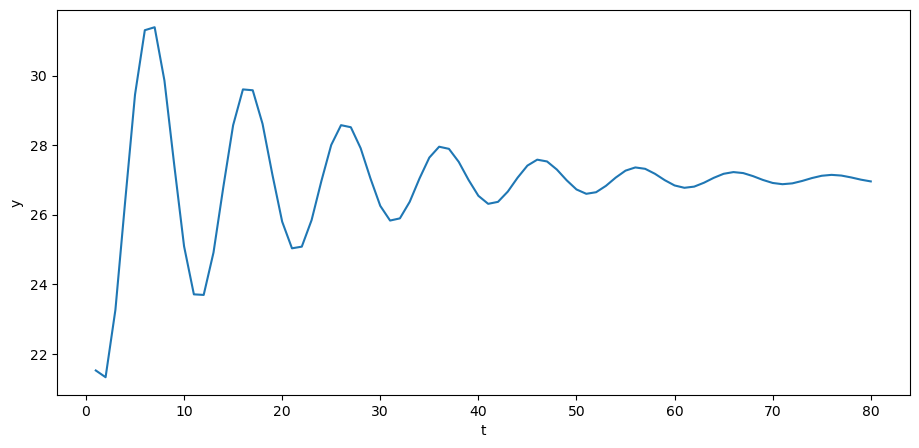

Now we can plot.

The *steady state* value

If we set the initial values to

y_star = α_0 / (1 - α_1 - α_2)

y_neg1_steady = y_star # y_{-1}

y_0_steady = y_star

b_steady = np.full(T, α_0)

b_steady[0] = α_0 + α_1 * y_0_steady + α_2 * y_neg1_steady

b_steady[1] = α_0 + α_2 * y_0_steady

y_steady = A_inv @ b_steady

36.3. Adding a random term#

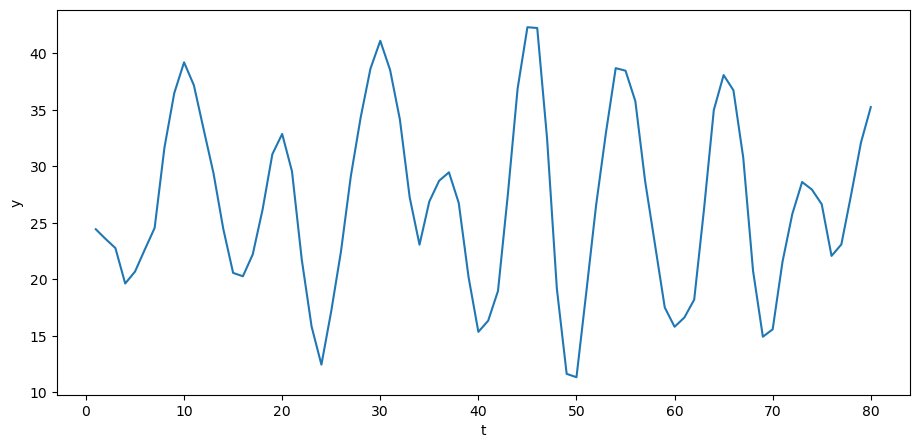

To generate some excitement, we’ll follow in the spirit of the great economists Eugen Slutsky and Ragnar Frisch and replace our original second-order difference equation with the following second-order stochastic linear difference equation:

where

We’ll stack these

Let’s define the random vector

Where

The solution for

Let’s try it out in Python.

σ_u = 2.

u = np.random.normal(0, σ_u, size=T)

y = A_inv @ (b + u)

The above time series looks a lot like (detrended) GDP series for a number of advanced countries in recent decades.

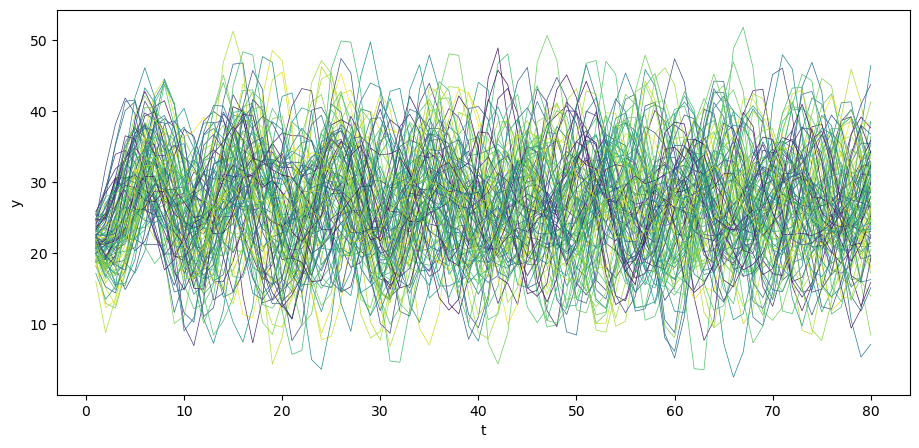

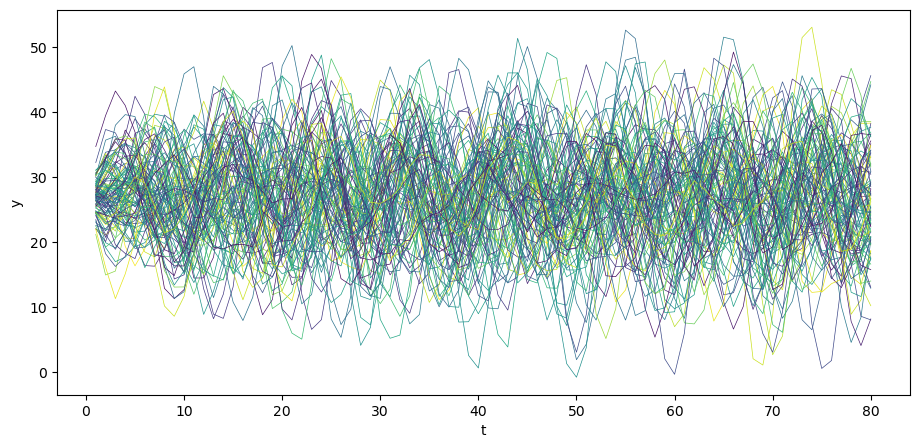

We can simulate

N = 100

for i in range(N):

col = cm.viridis(np.random.rand()) # Choose a random color from viridis

u = np.random.normal(0, σ_u, size=T)

y = A_inv @ (b + u)

plt.plot(np.arange(T)+1, y, lw=0.5, color=col)

plt.xlabel('t')

plt.ylabel('y')

plt.show()

Also consider the case when

36.4. Computing population moments#

We can apply standard formulas for multivariate normal distributions to compute the mean vector and covariance matrix for our time series model

You can read about multivariate normal distributions in this lecture Multivariate Normal Distribution.

Let’s write our model as

where

Because linear combinations of normal random variables are normal, we know that

where

and

Let’s write a Python class that computes the mean vector

class population_moments:

"""

Compute population moments μ_y, Σ_y.

---------

Parameters:

α_0, α_1, α_2, T, y_neg1, y_0

"""

def __init__(self, α_0=10.0,

α_1=1.53,

α_2=-.9,

T=80,

y_neg1=28.0,

y_0=24.0,

σ_u=1):

# compute A

A = np.identity(T)

for i in range(T):

if i-1 >= 0:

A[i, i-1] = -α_1

if i-2 >= 0:

A[i, i-2] = -α_2

# compute b

b = np.full(T, α_0)

b[0] = α_0 + α_1 * y_0 + α_2 * y_neg1

b[1] = α_0 + α_2 * y_0

# compute A inverse

A_inv = np.linalg.inv(A)

self.A, self.b, self.A_inv, self.σ_u, self.T = A, b, A_inv, σ_u, T

def sample_y(self, n):

"""

Give a sample of size n of y.

"""

A_inv, σ_u, b, T = self.A_inv, self.σ_u, self.b, self.T

us = np.random.normal(0, σ_u, size=[n, T])

ys = np.vstack([A_inv @ (b + u) for u in us])

return ys

def get_moments(self):

"""

Compute the population moments of y.

"""

A_inv, σ_u, b = self.A_inv, self.σ_u, self.b

# compute μ_y

self.μ_y = A_inv @ b

self.Σ_y = σ_u**2 * (A_inv @ A_inv.T)

return self.μ_y, self.Σ_y

series_process = population_moments()

μ_y, Σ_y = series_process.get_moments()

A_inv = series_process.A_inv

It is enlightening to study the

Among other things, we can use the class to exhibit how statistical stationarity of

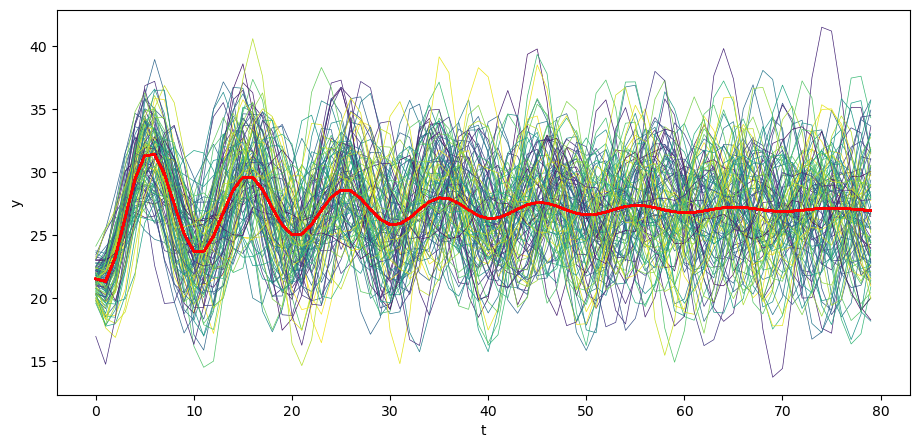

Let’s begin by generating

# Plot mean

N = 100

for i in range(N):

col = cm.viridis(np.random.rand()) # Choose a random color from viridis

ys = series_process.sample_y(N)

plt.plot(ys[i,:], lw=0.5, color=col)

plt.plot(μ_y, color='red')

plt.xlabel('t')

plt.ylabel('y')

plt.show()

Visually, notice how the variance across realizations of

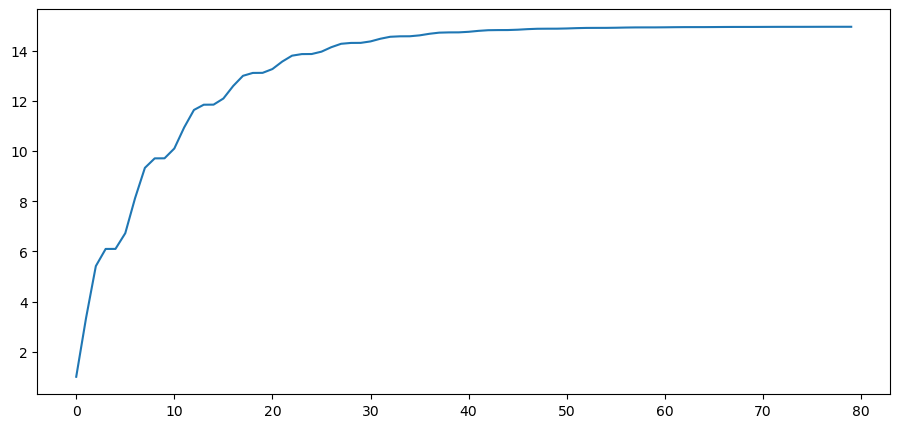

Let’s plot the population variance of

Notice how the population variance increases and asymptotes.

Let’s print out the covariance matrix

series_process = population_moments(α_0=0,

α_1=.8,

α_2=0,

T=6,

y_neg1=0.,

y_0=0.,

σ_u=1)

μ_y, Σ_y = series_process.get_moments()

print("μ_y = ", μ_y)

print("Σ_y = \n", Σ_y)

μ_y = [0. 0. 0. 0. 0. 0.]

Σ_y =

[[1. 0.8 0.64 0.512 0.41 0.328]

[0.8 1.64 1.312 1.05 0.84 0.672]

[0.64 1.312 2.05 1.64 1.312 1.049]

[0.512 1.05 1.64 2.312 1.849 1.48 ]

[0.41 0.84 1.312 1.849 2.48 1.984]

[0.328 0.672 1.049 1.48 1.984 2.587]]

Notice that the covariance between

This is an indication that the time series represented by our

To make it stationary, we’d have to alter our system so that our initial conditions

We describe how to do that in Linear State Space Models.

But just to set the stage for that analysis, let’s print out the bottom right corner of

series_process = population_moments()

μ_y, Σ_y = series_process.get_moments()

print("bottom right corner of Σ_y = \n", Σ_y[72:,72:])

bottom right corner of Σ_y =

[[ 14.965 12.051 4.969 -3.243 -9.434 -11.515 -9.128 -3.602]

[ 12.051 14.965 12.051 4.969 -3.243 -9.434 -11.515 -9.128]

[ 4.969 12.051 14.966 12.051 4.97 -3.243 -9.434 -11.516]

[ -3.243 4.969 12.051 14.966 12.052 4.97 -3.243 -9.434]

[ -9.434 -3.243 4.97 12.052 14.967 12.053 4.97 -3.243]

[-11.515 -9.434 -3.243 4.97 12.053 14.968 12.053 4.97 ]

[ -9.128 -11.515 -9.434 -3.243 4.97 12.053 14.968 12.053]

[ -3.602 -9.128 -11.516 -9.434 -3.243 4.97 12.053 14.968]]

Please notice how the subdiagonal and superdiagonal elements seem to have converged.

This is an indication that our process is asymptotically stationary.

You can read about stationarity of more general linear time series models in this lecture Linear State Space Models.

There is a lot to be learned about the process by staring at the off diagonal elements of

36.5. Moving average representation#

Let’s print out

is it triangular or almost triangular or

To study the structure of

Let’s begin by printing out just the upper left hand corner of

print(A_inv[0:7,0:7])

[[ 1. 0. -0. -0. 0. -0. -0. ]

[ 1.53 1. -0. -0. 0. -0. -0. ]

[ 1.441 1.53 1. 0. 0. 0. 0. ]

[ 0.828 1.441 1.53 1. 0. 0. 0. ]

[-0.031 0.828 1.441 1.53 1. -0. -0. ]

[-0.792 -0.031 0.828 1.441 1.53 1. 0. ]

[-1.184 -0.792 -0.031 0.828 1.441 1.53 1. ]]

Evidently,

Notice how every row ends with the previous row’s pre-diagonal entries.

Since

a time-dependent function

a weighted sum of current and past values of the IID shocks

Thus, let

Evidently, for

This is a moving average representation with time-varying coefficients.

Just as system (36.4) constitutes a

moving average representation for

36.6. A forward looking model#

Samuelson’s model is backward looking in the sense that we give it initial conditions and let it run.

Let’s now turn to model that is forward looking.

We apply similar linear algebra machinery to study a perfect foresight model widely used as a benchmark in macroeconomics and finance.

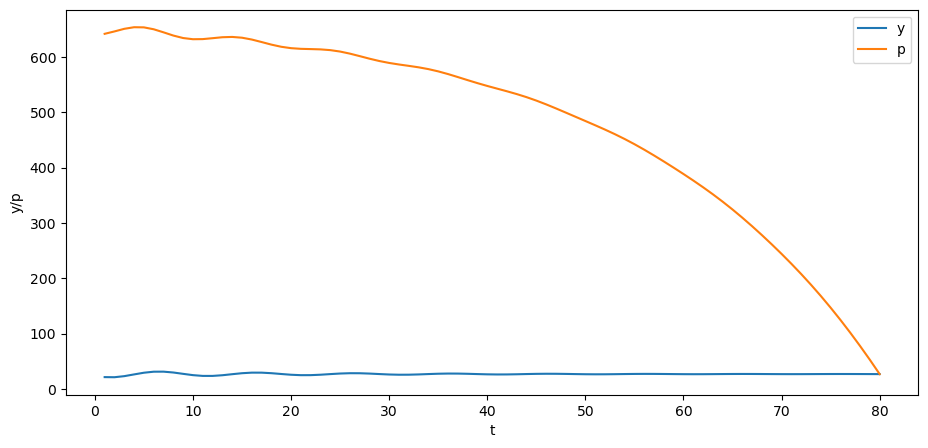

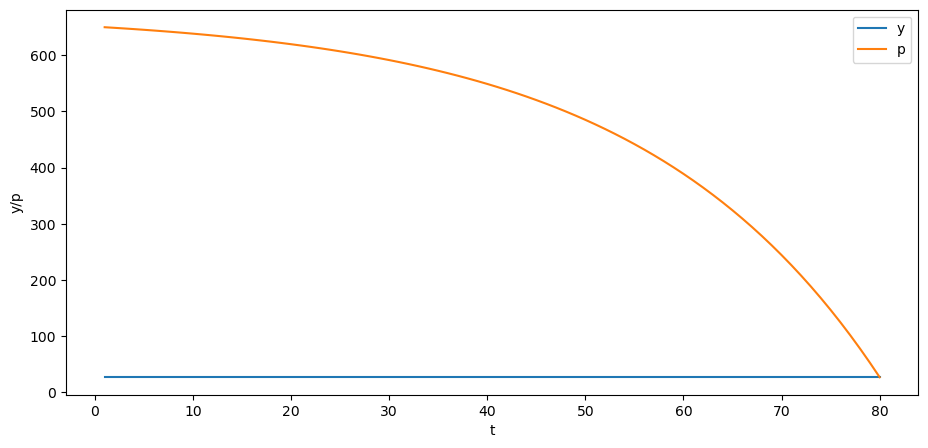

As an example, we suppose that

We assume that

Our perfect foresight model of stock prices is

where

The model asserts that the price of the stock at

Form

β = .96

# construct B

B = np.zeros((T, T))

for i in range(T):

B[i, i:] = β ** np.arange(0, T-i)

print(B)

[[1. 0.96 0.922 ... 0.043 0.041 0.04 ]

[0. 1. 0.96 ... 0.045 0.043 0.041]

[0. 0. 1. ... 0.047 0.045 0.043]

...

[0. 0. 0. ... 1. 0.96 0.922]

[0. 0. 0. ... 0. 1. 0.96 ]

[0. 0. 0. ... 0. 0. 1. ]]

σ_u = 0.

u = np.random.normal(0, σ_u, size=T)

y = A_inv @ (b + u)

y_steady = A_inv @ (b_steady + u)

p = B @ y

plt.plot(np.arange(0, T)+1, y, label='y')

plt.plot(np.arange(0, T)+1, p, label='p')

plt.xlabel('t')

plt.ylabel('y/p')

plt.legend()

plt.show()

Can you explain why the trend of the price is downward over time?

Also consider the case when